Comerford: Free community college plan will lift up students, offer immediate return on investment

A plan unveiled by Senate Democrats on Monday to make community college free for all in Massachusetts starting this fall has the potential to have a big impact for prospective students across the state, including here in the Pioneer Valley.The...

Sharing a few notes: High schoolers coaching younger string players one on one

AMHERST — Carefully holding and balancing his violin, 12-year-old Heedo Noh, a Fort River School sixth grader, gets a suggestion for positioning the bow so it runs straight across the strings as he practices G.F. Handel’s “Chorus from Judas...

Most Read

‘Home away from home’: North Amherst Library officially dedicated, as anonymous donor of $1.7M revealed

‘Home away from home’: North Amherst Library officially dedicated, as anonymous donor of $1.7M revealed

‘We can just be who we are’: Thousands show support for LGBTQ community at Hampshire Pride

‘We can just be who we are’: Thousands show support for LGBTQ community at Hampshire Pride

South Hadley man killed in I-91 crash

South Hadley man killed in I-91 crash

Retired superintendent to lead Hampshire Regional Schools on interim basis while search for permanent boss continues

Retired superintendent to lead Hampshire Regional Schools on interim basis while search for permanent boss continues

A Waterfront revival: Two years after buying closed tavern, Holyoke couple set to open new event venue

A Waterfront revival: Two years after buying closed tavern, Holyoke couple set to open new event venue

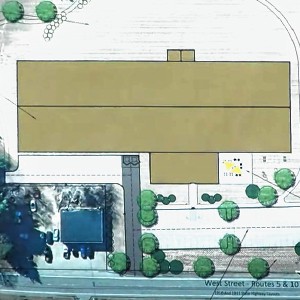

Proposed Hatfield pickleball/tennis building raising eyebrows

Proposed Hatfield pickleball/tennis building raising eyebrows

Editors Picks

A Look Back: May 7

A Look Back: May 7

Guest columnist Cathy McNally: Northampton School Committee standing up for children

Guest columnist Cathy McNally: Northampton School Committee standing up for children

Earth Matters: Honoring a local hero: After 40 years, Hitchcock Center bids farewell to educator and creative leader, Colleen Kelley

Earth Matters: Honoring a local hero: After 40 years, Hitchcock Center bids farewell to educator and creative leader, Colleen Kelley

The Beat Goes On: A trombone celebration in Holyoke, Lord Russ shifts gears, and the Hampshire Young People’s Chorus turns 25

The Beat Goes On: A trombone celebration in Holyoke, Lord Russ shifts gears, and the Hampshire Young People’s Chorus turns 25

Sports

Boys volleyball: Carey twins help power Frontier past Belchertown in straight sets (PHOTOS)

BELCHERTOWN — Throughout the entire offseason, Frontier senior Aleks Carey worked tirelessly to improve as a middle hitter so he could come back and dominate his position.When the season started, it became evident Carey was one of the best passers on...

Swayman stops 38 shots, Bruins roll past Panthers 5-1 for 1-0 series lead

Swayman stops 38 shots, Bruins roll past Panthers 5-1 for 1-0 series lead

Opinion

Guest column: Serving educational needs shouldn’t be ‘aspirational’

The School Committee recently passed a level services budget requiring an increase in its share of the city’s budget. My colleagues and I voted 8-1 — with the mayor abstaining — to pass this budget. We did so because we understand the challenges...

My Turn: Gaza and lies

My Turn: Gaza and lies

Guest columnist Mariel E. Addis: Pride and prejudice

Guest columnist Mariel E. Addis: Pride and prejudice

Guest columnist Gene Stamell: We know what we know

Guest columnist Gene Stamell: We know what we know

Jennifer Dieringer: Budget must serve whole city

Jennifer Dieringer: Budget must serve whole city

Business

Area property deed transfers, May 2

AMHERST Faheem Ibrahim Lt and Faheem Ibrahim to Nan Zhao and Zhihong Ni, 16 Arbor Way, $738,000 Richard B. Spurgin to Yg Pleasant LLC, East Pleasant Street, Lot 1, $218,000 Richard B. Spurgin to Yg Pleasant LLC, East Pleasant Street, Lot 2,...

Arts & Life

Speaking of Nature: Capturing my Bermuda nemesis: The Great Kiskadee nearly evaded me, until I followed its song

We’ve reached that point in the school year when it is actually painful (I mean physically painful) for me to leave my yard in the morning. May is the true month of the reawakening and blooming of Nature’s splendor and last week she was in full...

Obituaries

Eli Knapp Abrams

Eli Knapp Abrams

Florence, MA - Eli Knapp Abrams, of Florence Massachusetts, passed away suddenly on Monday, April 22nd, 2024 in Goshen, MA. Eli was born in Beverly, MA on March 19th, 2003. He is the cherished son of Jennifer and Maury Abrams, and belov... remainder of obit for Eli Knapp Abrams

Sandy A. Bell

Sandy A. Bell

Easthampton, MA - Sandra A. Bell, 77, of Easthampton passed away peacefully on May 2, 2024 at Cooley Dickinson Hospital after a brief illness surrounded by her family. Sandy was born October 28, 1946, in Fall River, MA to John and V... remainder of obit for Sandy A. Bell

Harold Portner

Harold Portner

Amherst, MA - It is with great sadness that we announce the passing of Harold (Hal) Portner, 93, of Amherst, MA on April 29, 2024. Hal was born in Hartford, CT on Dec. 5, 1930. Hal is predeceased by his parents Abraham and Leah (Specto... remainder of obit for Harold Portner

Juanita Canty

Juanita Canty

Hadley , MA - Juanita a proud Cuban and Sagittarian self-taught antiques dealer beloved wife of over 40 years mother, grandmother, great grandmother and to all a loyal and generous friend. She completed her earthly journey on April 26, ... remainder of obit for Juanita Canty

Easthampton to use built-up reserves to help cover $57.1M budget next year

Easthampton to use built-up reserves to help cover $57.1M budget next year

Town manager’s plan shorts Amherst Regional Schools’ budget

Town manager’s plan shorts Amherst Regional Schools’ budget

Fuller fends off challenge, wins 10th term on Chesterfield Select Board

Fuller fends off challenge, wins 10th term on Chesterfield Select Board

School assessment, electricity program among items on Pelham Town Meeting docket

School assessment, electricity program among items on Pelham Town Meeting docket

Easthampton native named Whately town administrator

Easthampton native named Whately town administrator

Public gets a look at progress on Northampton Resilience Hub

Public gets a look at progress on Northampton Resilience Hub

Police respond to alcohol-fueled incidents in Amherst

Police respond to alcohol-fueled incidents in Amherst

Former Easthampton firefighter to serve 8 months for filming colleagues in women’s locker room

Former Easthampton firefighter to serve 8 months for filming colleagues in women’s locker room

Bringing the Haitian vibe: Haitian Multicultural Day at Hopkins features Boston dance troupe

Bringing the Haitian vibe: Haitian Multicultural Day at Hopkins features Boston dance troupe

Baseball: Smith Academy edged by Logan Moore, Mohawk Trail in 1-0 loss (PHOTOS)

Baseball: Smith Academy edged by Logan Moore, Mohawk Trail in 1-0 loss (PHOTOS) High schools: Belchertown lacrosse seniors Paige Magner and Maddy LePage celebrate milestones

High schools: Belchertown lacrosse seniors Paige Magner and Maddy LePage celebrate milestones Track & field: Northampton, Amherst split final dual meets of the season (PHOTOS)

Track & field: Northampton, Amherst split final dual meets of the season (PHOTOS) Music key to Northampton’s downtown revival: State’s top economic development leader tours city

Music key to Northampton’s downtown revival: State’s top economic development leader tours city  Locking up carbon for good: Easthampton inventor’s CO2 removal system turns biomass into biochar

Locking up carbon for good: Easthampton inventor’s CO2 removal system turns biomass into biochar Advancing water treatment: UMass startup Elateq Inc. wins state grant to deploy new technology

Advancing water treatment: UMass startup Elateq Inc. wins state grant to deploy new technology New Realtor Association CEO looks to work collaboratively to maximize housing options

New Realtor Association CEO looks to work collaboratively to maximize housing options Easthampton author Emily Nagoski has done the research: It’s OK to love your body

Easthampton author Emily Nagoski has done the research: It’s OK to love your body Valley Bounty: Delivering local food onto students’ plates: Marty’s Local connects farms to businesses

Valley Bounty: Delivering local food onto students’ plates: Marty’s Local connects farms to businesses Let’s Talk Relationships: Breaking up is hard to do: These tools can help it feel easier

Let’s Talk Relationships: Breaking up is hard to do: These tools can help it feel easier The long shadow of the Mill River flood: Multiple events on tap in May to mark 150th anniversary of the 1874 disaster

The long shadow of the Mill River flood: Multiple events on tap in May to mark 150th anniversary of the 1874 disaster