Consumer corner with Anita Wilson: New Year’s resolutions are for more than diets and exercise

| Published: 01-18-2023 4:24 PM |

At the start of a new year, many people resolve to eat healthier or to get more exercise. As a consumer advocate, I suggest resolving to be better consumers. By doing so, you may be able to save money and avoid fraud. Here are my suggestions for consumer resolutions that could save you headaches and heartaches.

Order your credit reports from the three credit bureaus — Equifax, Experian, and TransUnion. You are entitled to one free report annually from each agency. To request yours, call 877-322-8228 or go online at annualcreditreport.com. You can also request them by mail by contacting each credit bureau directly.

Credit reports list a person’s loans and credit accounts as well as payment history. That information is used to determine your credit score which impacts whether you will be approved for credit as well as the interest rate you’ll pay. Requesting your free credit report will not affect your credit score. Your credit report may come with your credit score. Some credit card companies and banks also provide credit scores for free to their customers.

Go over your credit reports carefully verifying that the information listed is accurate and belongs to you. If you find accounts or loans that do not belong to you, contact the business that issued the account and the credit reporting agency. Incorrect information could lower your credit score and can also be a sign of identity theft where someone is using your personal information for their financial gain. If you believe you are the victim of identity theft you can fill out a report with the Federal Trade Commission at IdentityTheft.gov or by calling 877-438-4338.

Know your rights before making big purchases such as buying a car or hiring a contractor to do home improvements. In Massachusetts, there are specific laws and regulations that apply to automobile purchases and repairs as well as home improvement projects. Because these are some of the most expensive purchases consumers make, know your rights before signing on the dotted line. We have printed materials about these topics at our offices, and information in the consumer pages of our website, NorthwesternDA.org or at Mass.Gov.

Read the fine print before you agree to anything. Look over all pages before signing any financial agreements or contracts. Check the contract terms for the cancellation policy, the privacy policy, and the full cost of what you’re buying. It may seem tedious, but you want to know what your financial obligation is, who will have access to your personal information, and what your rights are in case something goes wrong.

Protect your personal and financial information online. Use multi-factor authentication on your accounts to make it more difficult for hackers to access your accounts. Multi-factor authentication sounds complicated, but it’s really not. Basically, it is a process that asks the user to enter a password and other information, such as a code sent by email or text message, to log into an account.

Other tips for safer cyber practices include: Choose strong passwords and don’t use the same password for all your accounts. Keep your computer, tablet, or smartphone secure by installing updates as soon as possible. You can turn on automatic updates in your device’s settings. Adjust privacy settings on social media accounts to control who can view your information and who can contact you.

Article continues after...

Yesterday's Most Read Articles

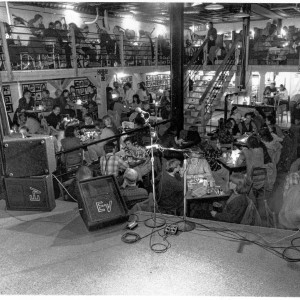

The Iron Horse rides again: The storied Northampton club will reopen at last, May 15

The Iron Horse rides again: The storied Northampton club will reopen at last, May 15

Homeless camp in Northampton ordered to disperse

Homeless camp in Northampton ordered to disperse

Authorities ID victim in Greenfield slaying

Authorities ID victim in Greenfield slaying

$100,000 theft: Granby Police seek help in ID’ing 3 who used dump truck to steal cash from ATM

$100,000 theft: Granby Police seek help in ID’ing 3 who used dump truck to steal cash from ATM

UMass football: Spring Game closes one chapter for Minutemen, 2024 season fast approaching

UMass football: Spring Game closes one chapter for Minutemen, 2024 season fast approaching

Final pick for Amherst regional superintendent, from Virgin Islands, aims to ‘lead with love’

Final pick for Amherst regional superintendent, from Virgin Islands, aims to ‘lead with love’

Think before you click. The U.S. Cybersecurity & Infrastructure Security estimates that more than 90% of successful cyber-attacks start with phishing emails, which are unsolicited communications that encourage recipients to click on links or open attachments. These are aimed at giving hackers access to a device and the owner’s information.

Phishing emails may also ask consumers to provide passwords and account information to steal money from bank accounts. Beware of surveys, contests, or giveaways that come through emails or text messages. Scammers often use them to collect your personal information and use it to commit fraud. Don’t worry about being impolite by not responding: It’s better to ignore.

Do your research when shopping online. If your unfamiliar with the company, search the name plus the words “scam” or “complaint” to see what other people have to say. Check the return and refund policy. Save the company’s contact information in case there’s a problem. Know the total cost including shipping, handling, taxes, and other fees before checking out. Always pay by credit card because if something goes wrong with the purchase, you can dispute the charge with your credit card company and get their assistance in resolving the problem.

Check your financial statements often for unwanted charges whether you receive online updates or printed documents. Look for charges on bank or credit card bills that you don’t recognize, and report them immediately. Check health insurance and Medicare statements carefully and report any discrepancies.

Keep your personal and financial information private. Think before sharing personal information such as your hometown or family information online. Never provide information about bank accounts, Social Security numbers, or other personal and financial information with anyone who calls, emails, or sends a text message because they might not be who they say they are.

Clean out your wallet or purse. Don’t carry all your credit cards in your wallet all the time, just carry what you need. Don’t carry your Social Security card, Medicare card, or health insurance card unless you need it for an appointment. Passports and birth certificates should be kept in a secure spot at home until needed. This can help minimize losses in case of a lost or stolen wallet.

And remember if a purchase or situation sounds too good to be true, it probably is. It’s always a good idea to check it out with a trusted friend or family member to see what they think.

If you’d like more information about your consumer rights, please contact our Northampton office at 413-586-9225 or our Greenfield office at 413-774-3186.

Anita Wilson is the director of the Northwestern District Attorney’s Office Consumer Protection Unit, which is a Local Consumer Program working in cooperation with the Office of the Massachusetts Attorney General.

Authorities ID victim in Greenfield slaying

Authorities ID victim in Greenfield slaying  Federal probe targets UMass response to anti-Arab incidents

Federal probe targets UMass response to anti-Arab incidents Locking up carbon for good: Easthampton inventor’s CO2 removal system turns biomass into biochar

Locking up carbon for good: Easthampton inventor’s CO2 removal system turns biomass into biochar William Strickland, a longtime civil rights activist, scholar and friend of Malcolm X, has died

William Strickland, a longtime civil rights activist, scholar and friend of Malcolm X, has died