Consumer Corner with Anita Wilson: Tips for increasing online security; advice on student loan repayments

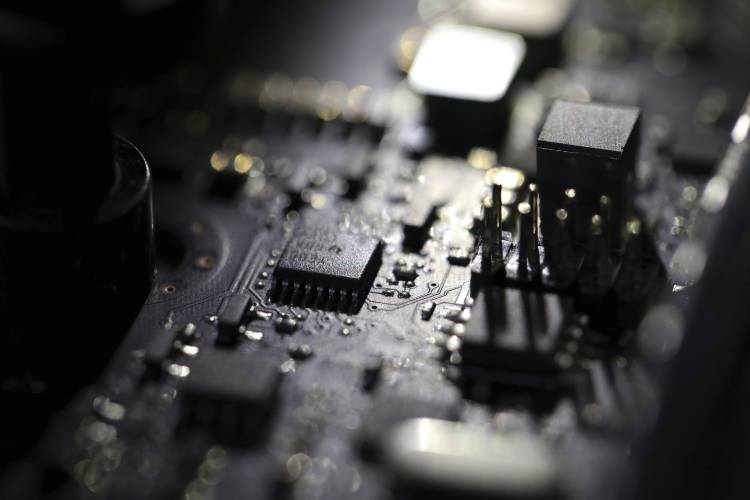

This Feb 23, 2019, file photo shows the inside of a computer in Jersey City, N.J. AP

| Published: 10-18-2023 2:00 PM |

I have two important pieces of consumer-related information to share with you this month. The first involves cybersecurity and the second focuses on federal student loan repayment.

October is National Cybersecurity Month, which means the federal Cybersecurity and Infrastructure Agency and the National Cybersecurity Alliance team up to raise awareness among consumers and businesses about the latest trends involving online safety and security.

This fall, they are recommending the following tips to stay safe online.

Recognize and report phishing. Phishing emails and text messages can easily appear like they’re from a company you know, such as your bank or credit card company, or a website or app. The message might say that they have noticed suspicious activity on your account, there is a problem with your account or payment information, that you need to confirm personal or financial information, or that they want you to click on a link to make a payment. They might also say you’re eligible for free items or encourage you to enter a giveaway.

By clicking onto an attachment or link or by responding to the message, you may accidentally download malware onto your device or give personal information to a scammer. To protect yourself, do not click or engage with these phishing attempts. Use the “report spam” feature on your smartphone for suspicious text messages or send the phishing message to the junk or spam file in your email account.

It is important that consumers understand that banks and credit companies will never ask you to send personal or account information through an email or text message. This means if you get such a message, you should be wary, and to confirm whether there is a problem with your account, call the bank or credit card company using the customer service number printed on the back of your card or on your account statement. Don’t use the telephone number, link, or website that is listed in the message no matter how real it looks.

Use strong passwords. Simple passwords can be guessed by hackers. Make passwords at least 16 characters long, random, and unique for each account. You may want to consider using a password manager, a secure program that maintains and creates passwords for you. These programs can be free or have a paid subscription. I can’t recommend a specific service but you can find more information here: staysafeonline.org/online-safety-privacy-basics/password-managers.

Turn on multifactor authentication (MFA). Multifactor authentication sounds complicated, but it’s not really. It is simply adopting an extra layer of security — in addition to a password — when you log into accounts and apps. When you use multifactor authentication, also known as two-step verification, it means you will receive a number code by text or email asking you to verify it is really you signing in.

Article continues after...

Yesterday's Most Read Articles

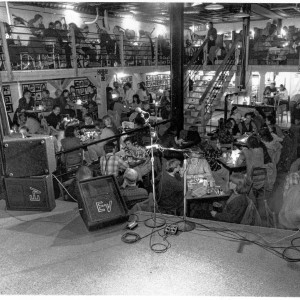

The Iron Horse rides again: The storied Northampton club will reopen at last, May 15

The Iron Horse rides again: The storied Northampton club will reopen at last, May 15

Homeless camp in Northampton ordered to disperse

Homeless camp in Northampton ordered to disperse

Authorities ID victim in Greenfield slaying

Authorities ID victim in Greenfield slaying

$100,000 theft: Granby Police seek help in ID’ing 3 who used dump truck to steal cash from ATM

$100,000 theft: Granby Police seek help in ID’ing 3 who used dump truck to steal cash from ATM

UMass football: Spring Game closes one chapter for Minutemen, 2024 season fast approaching

UMass football: Spring Game closes one chapter for Minutemen, 2024 season fast approaching

Final pick for Amherst regional superintendent, from Virgin Islands, aims to ‘lead with love’

Final pick for Amherst regional superintendent, from Virgin Islands, aims to ‘lead with love’

Another variation of authentication is to use facial recognition or fingerprints to confirm your identity. To activate this for your email account, for example, go into your account security settings and look for two-step verification or multifactor authentication, and follow the steps provided.

Update software. When devices, apps, or software programs notify you that updates are available, install them as soon as possible. These updates from software and app providers are designed to improve security or add new features to the program or app. These updates may pop up on your screen. Just know that not every pop-up window is legitimate. Scammers use them to try to fool you. I suggest people go to the settings tab on their devices to look for updates there. You can also turn on automatic updates in your settings. This will allow your device to install updates as soon as they are available.

If you’d like more information about online security and safety, go to the National Cybersecurity Alliance website staysafeonline.org. They have resources and videos about online privacy, how to tell if your computer has a virus, and much more to help you keep your computer and your personal information safe.

Federal student loan repayments for most borrowers are set to start up again this month. We recommend visiting studentaid.gov/manage-loans/repayment for information about restarting loan payments, repayment plans, and loan forgiveness.

The federal government suggests that you avoid companies offering help to enroll in a federal repayment plan or forgiveness program in exchange for paying “enrollment,” “subscription,” or “maintenance” fees. The U.S. Department of Education advises borrowers to contact the loan servicer directly for free help applying for repayment plans and student loan forgiveness. The name of the loan servicer can be found when you log into your account at studentaid.gov or by contacting the Federal Student Aid Information Center at 800-433-3243.

The Massachusetts Attorney General’s Office has a step-by-step guide to prepare for repayments at mass.gov/info-details/student-loan-assistance. The office also has a Student Loan Assistance Unit that can help borrowers obtain information about their loans, resolve disputes, get mistakes corrected, and explore repayment options. Their phone number is 888-830-6277 or submit a help request at their web page listed above.

If you have a consumer question, contact the Consumer Protection Unit in Greenfield at 413-774-3186 or in Northampton at 413-586-9225 or visit our website, NorthwesternDA.org/consumer-protection-unit.

Anita Wilson is director of the Northwestern District Attorney’s Office Consumer Protection Unit, which is a Local Consumer Program working in cooperation with the Office of the Massachusetts Attorney General.

Authorities ID victim in Greenfield slaying

Authorities ID victim in Greenfield slaying  Federal probe targets UMass response to anti-Arab incidents

Federal probe targets UMass response to anti-Arab incidents Locking up carbon for good: Easthampton inventor’s CO2 removal system turns biomass into biochar

Locking up carbon for good: Easthampton inventor’s CO2 removal system turns biomass into biochar William Strickland, a longtime civil rights activist, scholar and friend of Malcolm X, has died

William Strickland, a longtime civil rights activist, scholar and friend of Malcolm X, has died