College will cost up to $95,000 this fall: Schools say it's OK, financial aid can numb sticker shock

| Published: 04-04-2024 6:01 AM |

MEREDITH, N.H. — As more than 2 million graduating high school students from across the United States finalize their decisions on what college to attend this fall, many are facing jaw-dropping costs — in some cases, as much as $95,000.

A number of private colleges — some considered elite and others middle of the pack — have exceeded the $90,000 threshold for the first time this year as they set their annual costs for tuition, board, meals and other expenses. That means a wealthy family with three children could expect to shell out more than $1 million by the time their youngest child completes a four-year degree.

But the sticker price tells only part of the story. Many colleges with large endowments have become more focused in recent years on making college affordable for students who aren’t wealthy. Lower-income families may be required to pay just 10% of the advertised rate and, for some, attending a selective private college can turn out to be cheaper than a state institution.

“Ninety thousand dollars clearly is a lot of money, and it catches people’s attention, for sure,” said Phillip Levine, a professor of economics at Wellesley College near Boston. “But for most people, that is not how much they’re going to pay. The existence of a very generous financial aid system lowers that cost substantially.”

Wellesley is among the colleges where the costs for wealthy students will exceed $90,000 for the first time this fall, with an estimated price tag of $92,000. But the institution points out that nearly 60% of its students will receive financial aid, and the average amount of that aid is more than $62,000, reducing their costs by two-thirds.

But many prospective students this year are facing significant delays and anxiety in finding out how much aid they will be offered by colleges due to major problems with the rollout of a new U.S. Department of Education online form that was supposed to make applying for federal aid easier. Many colleges rely on information from the form for determining their own aid offers to students.

“The rollout has been pure chaos and an absolute disaster,” said Mark Kantrowitz, a financial aid expert.

As well as repeated delays and glitches, he said, there have been other problems with the new system including more stringent requirements for proof of identity from parents, which is deterring thousands of eligible but undocumented parents from applying — even though their children are U.S. citizens and entitled to aid.

Article continues after...

Yesterday's Most Read Articles

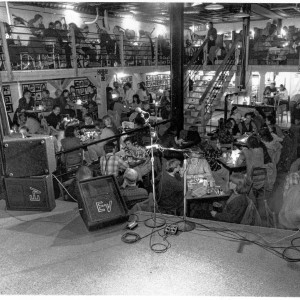

The Iron Horse rides again: The storied Northampton club will reopen at last, May 15

The Iron Horse rides again: The storied Northampton club will reopen at last, May 15

Homeless camp in Northampton ordered to disperse

Homeless camp in Northampton ordered to disperse

Authorities ID victim in Greenfield slaying

Authorities ID victim in Greenfield slaying

$100,000 theft: Granby Police seek help in ID’ing 3 who used dump truck to steal cash from ATM

$100,000 theft: Granby Police seek help in ID’ing 3 who used dump truck to steal cash from ATM

UMass football: Spring Game closes one chapter for Minutemen, 2024 season fast approaching

UMass football: Spring Game closes one chapter for Minutemen, 2024 season fast approaching

Final pick for Amherst regional superintendent, from Virgin Islands, aims to ‘lead with love’

Final pick for Amherst regional superintendent, from Virgin Islands, aims to ‘lead with love’

Kantrowitz said that if the significant drop in people applying for aid under the new system persists, it could result in lower enrollments and even force some institutions to close.

Levine said his research has shown that the amount lower-income students are paying at elite institutions has actually been declining over the past six years. But he worries that sticker shock will put off some students from even applying to institutions like Wellesley.

“People should be making educational decisions based on the actual cost they have to pay, not their perceived cost,” Levine said. “The problem is that the sticker price is the easiest number to know. It gets the most attention.”

Aside from Wellesley, some of the other colleges with sticker prices of more than $90,000 this year include the University of Southern California at $95,000, Harvey Mudd College in California at $93,000, the University of Pennsylvania at $92,000, Brown University in Rhode Island at $92,000, Dartmouth College in New Hampshire at $91,000 and Boston University at $90,000.

Harvard University in Cambridge, Mass., puts its cost of attendance this fall at up to $91,000 but makes the point that the average parent contribution is just $13,000 and almost a quarter of families pay nothing at all. Harvard can afford a particularly generous student aid program because it has an endowment worth more than $50 billion, the largest of any university.

The sticker prices don’t always provide apples-to-apples comparisons because some colleges include costs like health insurance and travel expenses, while others don’t.

And some colleges that last year had sticker prices of close to $90,000, including Columbia University in New York and the University of Chicago, have yet to reveal this year’s expected costs.

In its most recent analysis, the College Board estimated the average advertised costs for private nonprofit colleges last year were $60,000, compared to about $29,000 for students at public in-state institutions and $47,000 at public out-of-state institutions.

Kantrowitz said the average unmet need for students at four-year colleges is about $10,000 per year.

“So families are forced to borrow that money or come up with that money from some other source, and that’s on top of their share of college costs,” he said.

So is college a good investment?

Kantrowitz believes the answer is yes, so long as students borrow in moderation and complete their studies.

“If you graduate and you don’t take on a ridiculous amount of debt, you should be able to repay that debt in a reasonable amount of time,” Kantrowitz said. “But if you drop out, you have the debt, but not the degree that can help you repay the debt.”

Authorities ID victim in Greenfield slaying

Authorities ID victim in Greenfield slaying  Federal probe targets UMass response to anti-Arab incidents

Federal probe targets UMass response to anti-Arab incidents Locking up carbon for good: Easthampton inventor’s CO2 removal system turns biomass into biochar

Locking up carbon for good: Easthampton inventor’s CO2 removal system turns biomass into biochar William Strickland, a longtime civil rights activist, scholar and friend of Malcolm X, has died

William Strickland, a longtime civil rights activist, scholar and friend of Malcolm X, has died