Beacon Hill Roll Call, March 13-17

| Published: 03-24-2023 10:22 AM |

THE HOUSE AND SENATE: There were no roll calls in the House and Senate for the week of March 13-17.

This week, Beacon Hill Roll Call examines the salaries and other benefits received by local state senators.

$73,655 BASE SALARY FOR ALL 40 SENATORS — The new base salary for the 2023-2024 session for senators is $73,655 — up $3,119 (4.4%) from the $70,536 base salary in the 2021-2022 session.

Senators’ salaries are up for adjustment in January every two years, either up or down, under a 1998 constitutional amendment approved by a better than two-to-one margin by voters. It requires that every two years the salaries of the governor, the other five constitutional statewide officers and all representatives and senators be increased or decreased based on data from the Bureau of Economic Analysis that measures the quarterly change in salaries and wages.

Senators’ base salaries were increased by $2,515 for the 2021-2022 legislative session; $3,709 for the 2019-2020 session; and $2,515 for the 2017-2018 legislative session. Those hikes came on the heels of a salary freeze for the 2015-2016 legislative session, a $1,100 pay cut for the 2013-2014 session and a $306 pay cut for the 2011-2012 session. Prior to 2011, legislators’ salaries had been raised every two years since the $46,410 base pay was first raised under the constitutional amendment in 2001.

The new $73,655 base salary means senators’ base salaries have been raised $27,245, or 58%, since 2011 when the mandated salary adjustment became part of the state constitution and senators were earning $46,410.

EXTRA PAY FOR ALL 40 SENATORS — All 40 senators receive an additional stipend, above the $73,655 base salary, for their positions in the Democratic and Republican leadership, as committee chairs, vice chairs and the ranking Republican on some committees. The stipend is increased or decreased every two years based on data from the BEA that measures the quarterly change in salaries and wages.

Article continues after...

Yesterday's Most Read Articles

Pro-Palestinian protesters set up encampment at UMass flagship, joining growing national movement

Pro-Palestinian protesters set up encampment at UMass flagship, joining growing national movement

Island superintendent picked to lead Amherst-Pelham region schools

Island superintendent picked to lead Amherst-Pelham region schools

Sole over-budget bid could doom Jones Library expansion project

Sole over-budget bid could doom Jones Library expansion project

State fines Southampton’s ex-water chief for accepting lodging and meals at ski resort, golf outing from vendor

State fines Southampton’s ex-water chief for accepting lodging and meals at ski resort, golf outing from vendor

Authorities ID victim in Greenfield slaying

Authorities ID victim in Greenfield slaying

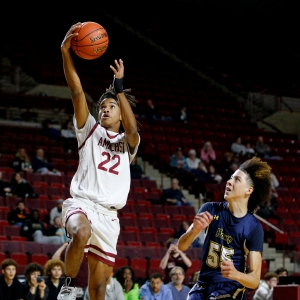

2024 Gazette Boys Basketball Player of the Year: Marcielo Aquino, Amherst

2024 Gazette Boys Basketball Player of the Year: Marcielo Aquino, Amherst

Senate President Karen Spilka (D-Ashland), the top Democrat, earns the highest stipend of any senator: $109,163. Senate Minority Leader Sen. Bruce Tarr (R-Gloucester), the top Republican, earns an $81,872 stipend. The other 38 senators’ stipends range from $27,564 to $102,430.

Supporters say legislators in these important positions should be appropriately compensated for their many added responsibilities and hard work.

Critics say the base salary is sufficient and is eligible to be increased every two years.

$20,468 OR $27,291 FOR GENERAL EXPENSES — Each senator also receives an annual general expense pay allowance of $20,468 for members who live within a 50-mile radius of the Statehouse and $27,291 for those who are located outside of that radius.

This separate, flat rate expense allowance is taxable as income. It is designed to pay for some of the costs of senators’ district offices and other expenses including contributions to local civic groups and the printing and mailing of newsletters. Senators are not required to submit an accounting of how they spend the money. But they are allowed to deduct any expenses, permitted under federal law, from their gross income on their federal and state tax return.

SOME SENATORS WHO LIVE 50 MILES FROM THE STATEHOUSE ARE ELIGIBLE TO PAY A REDUCED OR NO FEDERAL INCOME TAX ON THEIR LEGISLATIVE SALARY — Senators who live more than 50 miles from the Statehouse are eligible for a special federal tax break. A 1981 federal law allows them to write off a daily expense allowance when filing their federal income tax return. The complicated system determines a daily amount, ostensibly for meals, lodging and other expenses incurred in the course of their jobs, which can be deducted for every “legislative day.”

Under the Massachusetts Legislature’s system and schedule, every day of the year qualifies as a legislative day. The Legislature does not formally “prorogue” (end an annual session) until the next annual session begins. This allows legislators to take the deduction for all 365 days regardless of whether the Legislature is actually meeting or not. Legislators do not have to travel to the Statehouse to qualify for the daily deduction.

The amount of the deduction is based on the federal per diem for Massachusetts. It varies from year to year. The daily per diem for legislators for fiscal 2023 varies in different parts of the state and is seasonal. It ranges from $98 per day to $459 per day or between $35,770 and $167,535 annually.

Beacon Hill Roll Call’s research indicates that 11 of the state’s 40 legislators live more than 50 miles from the Statehouse, qualify for this deduction and are eligible to pay a reduced or no federal income tax on their legislative salaries.

PARKING SPACE — Senators are entitled to a parking space inside the Statehouse garage or at the nearby McCormack State Office Building. The first $300 in monthly value of the space is a tax-free benefit under federal and state guidelines that apply to all public and private employees, not just state senators. Any value of the space above this amount is treated as taxable income.

The value of the parking spaces in 2023 was determined by the Division of Capital Asset Management and Maintenance to be $449 per month. Based on that figure, legislators would be taxed on the excess $149 monthly by the Internal Revenue Service and the state.

HEALTH INSURANCE — Senators are eligible to choose from nine health insurance plans offered by the state’s Group Insurance Commission, which manages the plans for over 137,000 individuals — current and retired state workers, as well as certain municipal workers, and their dependents.

Senators elected on or before July 1, 2003, pay 20% of the total premium and the state pays 80%. Those elected to their first term on or after July 1, 2003 pay 25% while the state picks up only 75%. State and federal privacy regulations protect this information and it is not possible to obtain records about which plans individual legislators have purchased. The out-of-pocket monthly premiums paid by senators for family plans range from $311.02 to $788.43. For individual plans, they pay from $125.66 to $354.68 each month.

LIFE INSURANCE — Legislators who purchase a health insurance policy from the state are also required to buy the state’s basic $5,000 life insurance policy. This costs employees $1.27 to $1.59 per month, depending on the date of hire. The same 20/80, 25/75 formula used for health insurance also applies to this life insurance. Senators also have the option to buy additional life insurance with a value of up to eight times their salary. The entire premium for the optional insurance is paid by the senator.

LONG-TERM DISABILITY AND HEALTH CARE SPENDING ACCOUNT — Legislators also have the option to open a Health Care Spending Account (HCSA) and Dependent Care Assistance Program (DCAP), and to buy long-term disability insurance. The HCSA allows legislators to set aside funds to pay for out-of-pocket health care expenses with before-tax dollars while the DCAP allows them to set aside funds to pay for certain dependent care expenses with before-tax dollars. This participation reduces their federal and state income taxes. The entire premium for long-term disability is paid by legislators.

DENTAL AND VISION INSURANCE — Senators are eligible to choose one of two dental/vision insurance plans. Current monthly employee premium costs paid by senators for family plans range from $14.32 to $19.36, while individual plans range from $4.64 to $6.26. All senators pay 15% of the premium and the state pays 85%.

CATEGORY #1 - LOCAL SENATORS’ BASE SALARIES — Here are local senators’ base salaries. They are the same for all senators.

Sen. Joanne Comerford, $73,655; Sen. Paul Mark, $73,655; Sen. Jacob Oliveira, $73,655; Sen. John Velis, $73,655

CATEGORY #2 - LOCAL SENATORS’ STIPENDS

Here are local senators’ stipends for their positions in the Democratic and Republican leadership, as committee chairs, vice chairs and the ranking Republican on some committees.

Sen. Joanne Comerford, $40,936; Sen. Paul Mark, $27,564; Sen. Jacob Oliveira, $27,564; Sen. John Velis, $40,936

CATEGORY #3 - LOCAL SENATORS’ GENERAL EXPENSE PAY ALLOWANCE

Here are local senators’ pay for general office expenses. The amount is $20,468 for members who live within a 50-mile radius of the Statehouse and $27,291 for those who are located outside of that radius.

Sen. Joanne Comerford, $27,291; Sen. Paul Mark, $27,291; Sen. Jacob Oliveira, $27,291; Sen. John Velis, $27,291

GRAND TOTAL OF LOCAL SENATORS’ SALARIES

Here are the top 10 senators who are paid the highest salaries including the three categories of base pay, stipends and general expense pay allowance.

Karen Spilka (D-Ashland), $203,286; Michael Rodrigues (D-Westport), $196,736; Cynthia Stone Creem (D-Newton), $196,463, Michael Barrett (D-Lexington), $182,818; Sal DiDomenico (D-Everett), $182,818; Joan Lovely (D-Salem), $182,818; William Brownsberger (D-Belmont), $182,818; Cindy Friedman (D-Arlington), $175,995; Bruce Tarr (R-Gloucester), $175,995; Julian Cyr (D-Truro), $169,173

Here are local senators’ current total annual salary including the three categories of base pay, stipends and general expense pay allowance.

Sen. Joanne Comerford, $141,882; Sen. Paul Mark, $128,509; Sen. Jacob Oliveira, $128,509; Sen. John Velis $141,882

BAN SALE OF FUR PRODUCTS (S 590) — A bill before the Environment and Natural Resources Committee would make it illegal to sell a new manufactured fur product in Massachusetts and impose a fine between $500 and $5,000 per fur product for anyone convicted of the sale.

The measure exempts used fur products and fur products used for traditional tribal, cultural or spiritual purposes by a member of a federally recognized or state-recognized Native American tribe.

Supporters say that more than 100 million undomesticated animals like foxes, raccoon, dogs and mink are confined to small wire cages and then subjected to cruel killing methods that are not regulated by federal humane slaughter laws. They say that animal protection organizations have documented animals being gassed, electrocuted, bludgeoned to death and skinned alive. They noted that there are many fur alternatives available and urged Massachusetts to end its complicity in this truly horrible industry.

“Our commonwealth has long been a world leader in animal welfare,” said co-sponsor Rep. Jack Lewis (D-Framingham). “With evidence of inhumane practices in the fur industry, the risks fur production has to our public health, and the availability of so many different options for warm and fashionable fabrics, I look forward to ongoing conversations on this and other animal welfare bills this session.”

BURY PETS WITH OWNERS (S 1310) — A proposal before the Municipalities and Regional Government Committee would give cities and towns the right to give cemeteries the authority to allow the burial of people and their pets in the same location.

Supporters say people often consider their pets as members of their families and the current law prohibiting joint burial is unfair.

Opponents say that joint burial presents sanitary, environmental and religious concerns.

Sponsor Sen. Mark Montigny (D-New Bedford) did not respond to repeated requests by Beacon Hill Roll Call to comment on his proposal.

BAN DOXING (S 1116) — Legislation before the Judiciary Committee would ban doxing which is the knowing release of private personal identifying information of a person, without their consent, with the intent to intimidate, harass or cause stalking, physical harm or serious property damage. Currently there is no state law that makes doxing a crime.

“Doxing is a hateful act that goes far beyond violating one’s privacy,” said sponsor Sen. Becca Rausch (D-Needham). “It is used to intimidate, harass and jeopardize one’s safety. Online harassment has real-life implications and can no longer be tolerated. We need legislation to address this continual trend of online doxing and harassment, and protect citizens from experiencing such egregious behavior within the commonwealth.”

RIGHT TO DIE/ASSISTED SUICIDE/END OF LIFE OPTIONS (S 1331) — This bill, known by many names, would give a terminally ill, mentally capable adult with a prognosis of six months or less to live the option to request, obtain and ingest medication — to die in their sleep if their suffering becomes unbearable. It is currently before the Judiciary Committee.

Supporters say the bill is modeled after the Oregon Death with Dignity Act, which has been in practice for 25 years without a single instance of abuse or coercion. They note the bill includes several core safeguards including requiring the terminal illness and six-month prognosis to be confirmed by two doctors; requiring the attending physician to inform the individual about all of their end-of-life care options, including hospice and pain or symptom management; and allowing the terminally ill person to withdraw their request for medication, not take the medication once they have it or otherwise change their mind at any point.

Sponsor Sen. Jo Comerford (D-Northampton) said she is working with her co-sponsors and other supporters to get this bill through the Legislature this session. “Individuals with terminal diagnoses should have access to safe options,” said Comerford.

QUOTABLE QUOTES

“As we continue to experience the aftermath and trauma of senseless gun violence in our communities, we must utilize all available resources to stop these tragedies. My colleagues and I urge these credit companies not to cave to political pressure and to move forward with what will be an important resource in detecting, identifying and stopping potential threats to public safety.”

Attorney General Andrea Campbell urging Visa, American Express, Mastercard and Discover to honor their commitment made in September to implement a new merchant code for gun sales. The companies recently announced they were no longer planning on implementing the code, citing legislation in several states seeking to bar or limit the use of the voluntary code.

“The bill … would impose a fee on the largest emitters of greenhouse gasses in Massachusetts, that would go into a climate resiliency superfund. These would be polluters like Shell Oil whose profits doubled in 2022 to $42 billion or ExxonMobile which reported a record $56 billion in profits.”

Rep. Steve Owens (D-Watertown) on his bill to hold top polluters financially responsible for climate change.

“Cocktails to-go were allowed during the pandemic to support struggling hospitality businesses which represent thousands of jobs across Massachusetts. Since then, cocktails to-go have become a regular part of takeout dining for adult consumers and a stable source of revenue for hospitality businesses as they continue to recover from the lasting impacts of COVID-19.”

Andy Deloney, senior vice president at the Distilled Spirits Council of the United States, urging the Legislature to extend for one year the law allowing restaurants to sell beer, wine and cocktails with takeout orders. The law is set to expire on April 1.

A Waterfront revival: Two years after buying closed tavern, Holyoke couple set to open new event venue

A Waterfront revival: Two years after buying closed tavern, Holyoke couple set to open new event venue  Area property deed transfers, May 2

Area property deed transfers, May 2 Pro-Palestinian encampment disperses at UMass, but protests continue

Pro-Palestinian encampment disperses at UMass, but protests continue Amherst council confirms Gabriel Ting as police chief

Amherst council confirms Gabriel Ting as police chief