Property taxes in Amherst to jump an average of $375 next year

| Published: 11-22-2022 12:05 PM |

AMHERST — Tax bills for an average homeowner in Amherst will be going up by about $375 in the coming year, based on revised information following the Town Council’s recent approval of a single tax rate for fiscal year 2023.

Councilors at their Nov. 7 meeting supported a recommendation from Assessor Kimberly Mew and Town Manager Paul Bockelman that maintains a single tax rate for all 6,938 taxable properties in town, of which 6,312, or 88%, are considered residential. Amherst also has 419 commercial properties, 30 industrial properties and 177 personal properties.

Mew’s initial presentation showed that the tax rate would drop from $21.27 per $1,000 valuation to $20.10 per $1,000 valuation, while the average home valuation is going up from $404,700 last year to $446,953 this year. That means the average tax bill would rise by $374, or 4.4%, from $8,608 last year to $8,984 this year, according to Mew’s calculations.

With nearly nine in 10 properties classified as residential, Amherst is not in a good position to shift more of the tax burden to commercial properties, Mew said. Typically, cities and towns that do not have at least 30% of properties in the commercial category don’t attempt to make them carry more of the property tax burden, she said.

“We’re not quite in the best share to do that with,” Mew said.

Councilors also voted against adopting a residential exemption that could mean higher costs being passed on to renters. The residential exemption is a policy that shifts the tax burden away from lower valued owner-occupied properties onto other types of residential properties.

The vote in favor of setting the single tax rate came despite continued concerns expressed by councilors that Amherst officials should find a way to ensure that investment companies buying up single-family homes to convert them into rentals, primarily for off-campus students at the University of Massachusetts, are paying their fair share.

During the initial presentation, District 4 Councilor Pamela Rooney said officials should think more broadly of what a business is, observing that investment money coming into town, and the revenue made from renting homes, should be captured by Amherst.

Article continues after...

Yesterday's Most Read Articles

A Waterfront revival: Two years after buying closed tavern, Holyoke couple set to open new event venue

A Waterfront revival: Two years after buying closed tavern, Holyoke couple set to open new event venue

3-unit, 10-bed house in backyard called too much for Amherst historic district

3-unit, 10-bed house in backyard called too much for Amherst historic district

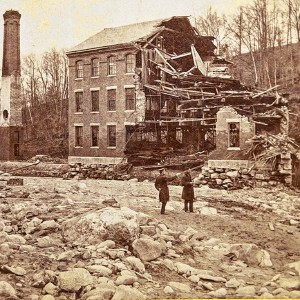

The long shadow of the Mill River flood: Multiple events on tap in May to mark 150th anniversary of the 1874 disaster

The long shadow of the Mill River flood: Multiple events on tap in May to mark 150th anniversary of the 1874 disaster

ValleyBike to roll again by end of May in eight communities throughout Valley

ValleyBike to roll again by end of May in eight communities throughout Valley

Amherst College store opens downtown in former Hastings space

Amherst College store opens downtown in former Hastings space

Area property deed transfers, May 2

Area property deed transfers, May 2

“I think it’s an industry in town. It’s an income base in town,” Rooney said.

Mew’s statistics show that 4,161 residential properties, or about two-thirds of residences in town, are owner-occupied, with the remaining 2,151 residential properties are rentals, including everything from large-scale apartment complexes to single-family homes in which rooms are rented out.

But in conversations with the state’s Department of Revenue, Mew said it would be difficult to target all rental properties in the way Rooney contemplates doing. The town uses a sales method to get the value of single-family homes, whether ones being bought by people who will live in them, or out-of-town investors.

Mew said Amherst would have to switch to using what is known as the “income-and-expense” method for getting the value on all properties, rather than the sales method. The state has informed the town it can’t pick and choose which method to use based on a specific property.

“Unfortunately, that’s a tough situation,” Mew said. “We’re restricted to how we value those particular parcels.”

District 3 Councilor Dorothy Pam said the method used to get values on non-owner occupied homes should be used throughout town. “Why wouldn’t that be an obvious thing to do?” Pam said, adding that she hears a lot of complaints from constituents about the town’s high taxes.

In addition, in response to a question from District 3 Councilor Jennifer Taub, Mew said apartment complexes can’t be considered commercial properties because they are principally residential sites.

Finance Director Sean Mangano said the town does use the “income-and-expense” method for valuing apartment complexes because sales of those properties are uncommon.

Even without the state’s support for trying to get investors to pay more on residential properties they buy, Mangano said the town can investigate what options are available. “We’ll continue to look at it,” Mangano said.

The town did a study last year indicating the danger of the residential exemption to low-income renters of increased rents, and other unintended consequences, including that a property may be non-owner-occupied for reasons other than renting to students, such as a person continuing to live in a house after assigning ownership to a child or parent who live elsewhere.

At Large Councilor Mandi Jo Hanneke said it would be hard to justify any system that would increase the costs of rent and make rental housing stock less affordable. The town has been confronting this already as it discusses revisions in the rental bylaw and whether tenants might end up paying more if there is greater town oversight of these properties.

Scott Merzbach can be reached at smerzbach@gazettenet.com.

Doors open at Tilton Library’s temporary home at South Deerfield Congregational Church

Doors open at Tilton Library’s temporary home at South Deerfield Congregational Church Pro-Palestinian encampment disperses at UMass, but protests continue

Pro-Palestinian encampment disperses at UMass, but protests continue Amherst council confirms Gabriel Ting as police chief

Amherst council confirms Gabriel Ting as police chief