Florence Bank CEO John Heaps announces retirement

| Published: 01-29-2020 8:27 PM |

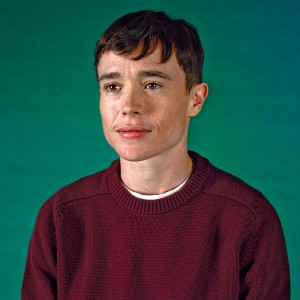

NORTHAMPTON — For John F. Heaps Jr., president and CEO of Florence Bank, giving back to the community and providing good customer service isn’t just an expectation.

“It’s our responsibility,” he said.

Since he started in his position in 1995, Heaps, 71, said he’s used that mindset to focus his efforts while leading the local bank. But come May 1, exactly 25 years to the day he took his current position, Heaps will retire from the organization.

“I’ve always been the optimist, and for me, I’ve approached every part of my life as an optimist,” Heaps said Wednesday in his office on Main Street in Florence. “And there’s no reason why this part of my life won’t be the same. So I’m looking forward to it.”

The end of Heaps’ tenure will secure him as the longest-serving CEO in Florence Bank’s 147-year history. He will be succeeded by Kevin Day, who joined the bank 11 years ago as its chief financial officer. Day took over the roles of president and chief operating officer on Tuesday, and will add CEO to his title when Heaps steps down in May.

“It was critical for us that we had somebody internal,” Heaps said. “The last thing we wanted to do was to go outside, and to go do a search, and to bring someone in that wasn’t part of the culture.”

With no stockholders or obligations to pay dividends, Heaps said the organization’s model as a mutual savings bank has given leadership the opportunity to “make decisions long-term without worrying about earnings.”

According to Heaps, that model has paid off in the past 25 years, as Florence Bank’s capital has grown from $24 million to $161 million, and assets have grown from $283 million to $1.4 billion. The bank has grown from four branches in 1995 and is planning on opening its 12th this year in Chicopee; staff at Florence Bank has nearly doubled from 112 full-time employees to 221.

Article continues after...

Yesterday's Most Read Articles

South Hadley’s Lauren Marjanski signs National Letter of Intent to play soccer at Siena College

South Hadley’s Lauren Marjanski signs National Letter of Intent to play soccer at Siena College

LightHouse Holyoke to buy Gateway City Arts, expand offerings and enrollment at alternative school

LightHouse Holyoke to buy Gateway City Arts, expand offerings and enrollment at alternative school

Treehouse, Big Brothers Big Sisters turn race schedule snafu into positive

Treehouse, Big Brothers Big Sisters turn race schedule snafu into positive

South Hadley man fatally shot in attempted robbery

South Hadley man fatally shot in attempted robbery

Granby man admits guilt, gets 2½ years in vehicular homicide

Granby man admits guilt, gets 2½ years in vehicular homicide

Area briefs: Transhealth to celebrate 3 year; Holyoke to plant tree at museum; Documentary film about reparations focus of Unitarian talk

Area briefs: Transhealth to celebrate 3 year; Holyoke to plant tree at museum; Documentary film about reparations focus of Unitarian talk

“I’m proud of the fact that we’ve had some great growth — I would say controlled growth,” he said.

But Heaps said he’s most proud of starting the bank’s “Customers’ Choice” program in 2002, which allows customers to vote on which nonprofits will receive grants from an annual pool of $100,000. The program was suggested by Heaps’ late wife, Jane, and has provided over $1.1 million to organizations across the region. Overall, Florence Bank gives out around $600,000 annually.

Heaps, who grew up in Springfield, remembers trips he took to the Northampton and Amherst survival centers while he was involved with the United Way, saying those experiences helped push him to give back.

“Some of those (centers) just really hit home for me,” Heaps said. “That was very, very meaningful for me, in terms of understanding this community and how it works.”

Over the past 25 years, Heaps said, Florence Bank has had to deal with the challenges new technology, such as mobile banking, brings to his industry. Easier ways to deposit checks along with other technological conveniences have decreased in-branch transactions by 30 percent, he said.

Heaps said he’s managed to stay ahead of those changes, as he sits on the board of directors of Florence Bank’s online provider, the Connecticut Online Computer Center Inc. — which he said helped his bank provide the same level of service as larger financial organizations like Bank of America.

“We’ve always said ‘We’re not going to be on the bleeding edge but we’re going to be on the leading edge,’” Heaps said. “In order to be relevant, you can’t be afraid to take some risks.”

Calling Day’s transition into president and CEO “smooth,” Heaps said Day will have to continue Florence Bank’s growth and said he’s confident that Day will maintain Florence Bank’s company culture.

“He presented last night … basically the same strategic plan we put in place a couple of years ago,” Heaps said.

Bob Borawski, president of Borawski Insurance in Northampton, serves as chairman of Florence Bank’s board of directors and was on the search committee that initially hired Heaps.

“We really didn’t appreciate who we were hiring at the time, we didn’t realize how well known locally he was and the deep roots he had in the community,” Borawski said. “We really got more than we bargained for — we were really lucky.”

Borawski said that Heaps led Florence Bank through the 2008 banking crisis “without any incident” in a time when most other banks were struggling.

“Before we knew it, we were right where we needed to be,” Borawski said. “I would say that was a defining moment in his career, how good of a banker he is.”

Come his retirement, Heaps said he’s going to spend time with his 10 grandchildren, play golf and travel. He’s even booked a cruise down the Nile River in Egypt immediately after he retires. He will also continue to sit on the board of directors for the Savings Bank Life Insurance Co. of Massachusetts, though he said he will not serve on Florence Bank’s board.

“I’ve loved it here, I’ve loved my job every day and I’m the luckiest guy in the world,” Heaps said. “And I’m going to approach the rest of my life the same way, with optimism, and I’ll make a success out of it.”

Michael Connors can be reached at mconnors@gazettenet.com.

William Strickland, a longtime civil rights activist, scholar and friend of Malcolm X, has died

William Strickland, a longtime civil rights activist, scholar and friend of Malcolm X, has died Advancing water treatment: UMass startup Elateq Inc. wins state grant to deploy new technology

Advancing water treatment: UMass startup Elateq Inc. wins state grant to deploy new technology New Realtor Association CEO looks to work collaboratively to maximize housing options

New Realtor Association CEO looks to work collaboratively to maximize housing options Northampton man will go to trial on first-degree murder charge after plea agreement talks break down

Northampton man will go to trial on first-degree murder charge after plea agreement talks break down