Latest News

Contested races shaping up in Chesterfield

Contested races shaping up in Chesterfield

Making news in business, May 2

Making news in business, May 2

Area property deed transfers, May 2

Area property deed transfers, May 2

Student voting petition rejected in Deerfield

Student voting petition rejected in Deerfield

Columnist J.M. Sorrell: Days to remember

Columnist J.M. Sorrell: Days to remember

Granby Bow and Gun Club says stray bullets that hit homes in Belchertown did not come from its range

BELCHERTOWN — The president of the Granby Bow and Gun Club insists that stray bullets that hit several homes in the Turkey Hill area of town did not originate from the club’s long range. Club President Ryan Downing read a statement at the beginning of...

A Waterfront revival: Two years after buying closed tavern, Holyoke couple set to open new event venue

HOLYOKE — After almost two years of reconstruction and remodeling, the Waterfront, Holyoke’s new event venue, is ready for its public unveiling.Owners Carlos and Evelyn Colón and family will host a grand opening Saturday from 11 a.m. to 3 p.m. with...

Most Read

Pro-Palestinian protesters set up encampment at UMass flagship, joining growing national movement

Pro-Palestinian protesters set up encampment at UMass flagship, joining growing national movement

Island superintendent picked to lead Amherst-Pelham region schools

Island superintendent picked to lead Amherst-Pelham region schools

Sole over-budget bid could doom Jones Library expansion project

Sole over-budget bid could doom Jones Library expansion project

State fines Southampton’s ex-water chief for accepting lodging and meals at ski resort, golf outing from vendor

State fines Southampton’s ex-water chief for accepting lodging and meals at ski resort, golf outing from vendor

Authorities ID victim in Greenfield slaying

Authorities ID victim in Greenfield slaying

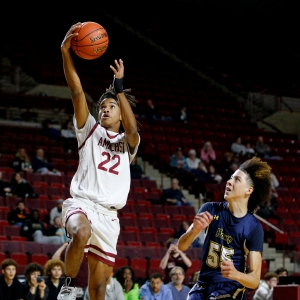

2024 Gazette Boys Basketball Player of the Year: Marcielo Aquino, Amherst

2024 Gazette Boys Basketball Player of the Year: Marcielo Aquino, Amherst

Editors Picks

A Look Back, May 1

A Look Back, May 1

Photos: Special connection

Photos: Special connection

The power of poetry: U.S. Poet Laureate Ada Limón to speak at Smith College

The power of poetry: U.S. Poet Laureate Ada Limón to speak at Smith College

The Beat Goes On: Album release shows by Barnstar! and Lisa Bastoni, a Young@Heart Chorus concert with new special guests, and more

The Beat Goes On: Album release shows by Barnstar! and Lisa Bastoni, a Young@Heart Chorus concert with new special guests, and more

Sports

2024 Gazette Boys Swimmer of the Year: Luke Giguere, Belchertown

BELCHERTOWN — He didn’t think it would ever happen outside of a regular season dual meet, but Luke Giguere had just done something swimmers only dream of.The Belchertown senior put forth a heroic 46.62-second anchor leg in the 400-yard freestyle relay...

2024 Gazette Girls Swimmer of the Year: Ursula von Goeler, Northampton

2024 Gazette Girls Swimmer of the Year: Ursula von Goeler, Northampton

MIAA power rankings: See where all the local teams are ranked

MIAA power rankings: See where all the local teams are ranked

Opinion

Guest columnist Owen Mitz: A hybrid suggestion for King Street

Driving into Northampton south on King Street after getting off I-91, we are greeted by a number of tire stores, fast food establishments, auto dealers, auto body shops, drug stores (both types), food and liquor stores, and an occasional different...

Paul Craig: Gun control debate a fractured discourse

Paul Craig: Gun control debate a fractured discourse

Byron Coley: Shores Ness for Select Board

Byron Coley: Shores Ness for Select Board

Bernie Sadoski: Blake Gilmore is committed to his community

Bernie Sadoski: Blake Gilmore is committed to his community

Business

Music key to Northampton’s downtown revival: State’s top economic development leader tours city

NORTHAMPTON — When she was a student at Williams College, Yvonne Hao recalls traveling to Northampton with friends to eat at local restaurants, shop at thrift stores and attend concerts held by the local music scene, although she isn’t quite sure of...

New Realtor Association CEO looks to work collaboratively to maximize housing options

New Realtor Association CEO looks to work collaboratively to maximize housing options

Area property deed transfers, April 25

Area property deed transfers, April 25

Arts & Life

Speaking of Nature: Bird of my dreams, it’s you: Spotting a White-tailed Tropicbird on our cruise in Bermuda

It was the morning of April 16 and I was up early. It seems to be impossible for me to sleep late at this time of year because I am so excited about seeing the first birds of the season, but this particular morning was a little different. It was the...

Obituaries

Eli Knapp Abrams

Eli Knapp Abrams

Florence, MA - Eli Knapp Abrams, of Florence Massachusetts, passed away suddenly on Monday, April 22nd, 2024 in Goshen, MA. Eli was born in Beverly, MA on March 19th, 2003. He is the cherished son of Jennifer and Maury Abrams, and belov... remainder of obit for Eli Knapp Abrams

Ronald O'brien

Ronald O'brien

Northampton, MA - Ronald Paul O'Brien, 76, passed away peacefully at Cooley Dickinson Hospital after a brief illness. Born in St. Stephens New Brunswick, Canada, the O'Briens immigrated to the United States where Ronald grew up and atte... remainder of obit for Ronald O'brien

Jennifer M. Read

Jennifer M. Read

South Deerfield, MA - Jennifer Read of South Deerfield, beloved wife and mother, died peacefully on April 21, 2024 at the age of 79 after a long struggle with Alzheimer's disease. Jennifer was born on January 1, 1945 at Brooklyn Naval ... remainder of obit for Jennifer M. Read

Helen A. Torrey

Helen A. Torrey

Florence, MA - Helen A. (Fogg) Torrey, 77, of Florence, passed away peacefully on Friday, April 26, 2024, at Cooley Dickinson Hospital in Northampton. Helen was born July 20, 1946, in Northampton to John and Arabelle (Knox) Fogg. She wa... remainder of obit for Helen A. Torrey

Glitz, glamour and all that jazz: ‘Chicago’ takes stage at Easthampton High starting Thursday

Glitz, glamour and all that jazz: ‘Chicago’ takes stage at Easthampton High starting Thursday

Healey expects $16B return on climate tech investment

Healey expects $16B return on climate tech investment

Amherst council hears call to scale back Jones work

Amherst council hears call to scale back Jones work

Amherst council confirms Gabriel Ting as police chief

Amherst council confirms Gabriel Ting as police chief

Girls lacrosse: Amherst stays undefeated, runs away from Granby for second win in as many days (PHOTOS)

Girls lacrosse: Amherst stays undefeated, runs away from Granby for second win in as many days (PHOTOS) Softball: Ella Schaeffer’s walk-off hit lifts South Hadley to 1-0 extra-inning win over Easthampton

Softball: Ella Schaeffer’s walk-off hit lifts South Hadley to 1-0 extra-inning win over Easthampton Guest columnist Sarah Willie-LeBreton: Smith College and the city — Neighborliness and much more

Guest columnist Sarah Willie-LeBreton: Smith College and the city — Neighborliness and much more Locking up carbon for good: Easthampton inventor’s CO2 removal system turns biomass into biochar

Locking up carbon for good: Easthampton inventor’s CO2 removal system turns biomass into biochar Advancing water treatment: UMass startup Elateq Inc. wins state grant to deploy new technology

Advancing water treatment: UMass startup Elateq Inc. wins state grant to deploy new technology The Iron Horse rides again: The storied Northampton club will reopen at last, May 15

The Iron Horse rides again: The storied Northampton club will reopen at last, May 15 Upon Nancy’s Floor: 33 Hawley event celebrates iconic dancers, history, and a new dance floor

Upon Nancy’s Floor: 33 Hawley event celebrates iconic dancers, history, and a new dance floor Embracing both new and old: Da Camera Singers celebrates 50 years in the best way they know how

Embracing both new and old: Da Camera Singers celebrates 50 years in the best way they know how Time to celebrate kids and books: Mass Kids Lit Fest offers a wealth of programs in Valley during Children’s Book Week

Time to celebrate kids and books: Mass Kids Lit Fest offers a wealth of programs in Valley during Children’s Book Week