Signs of a housing cooldown: Valley home sales drop, prices stay high

| Published: 02-22-2023 6:04 PM |

NORTHAMPTON — Signs of a cooling real estate market continued to emerge in January, according to figures from the Realtor Association of the Pioneer Valley, with home sales dropping by almost 50% compared to January 2022 in Hampshire County.

The figures continued a trend from December, when The Warren Group reported single-family home sales across Massachusetts declining by 31.7% from sales during December 2021.

“The Massachusetts single-family market finally hit that wall we’ve all been anticipating,” stated Tim Warren, CEO of The Warren Group.

Sales volume was down last month across Hampshire, Hampden and Franklin counties, Realtor Association data show, but in spite of the slowdown, prices on average have continued to rise. In Hampshire County, although only 44 homes sold last month compared to 87 in January 2022, the median sales price rose by 7.3% to $391,500.

“The volume (of sales) has definitely decreased,” said Barbara Jean Deloria, senior vice president and credit risk manager at Florence Bank.

Less than a year ago, the Federal Reserve began raising its key interest rate in an effort to tamp down inflation, and rising interest rates have clearly had an effect, Deloria said. Compared to a year ago, when Florence Bank offered mortgages at 3.625%, the rate for a first-time homebuyer now is 5.75%.

Additionally, there are fewer homes for sale — and that has maintained upward pressure on prices.

In fact, while single-family home and condominium prices across Massachusetts continued to set records in January, sales activity plummeted by double digits, with the fewest single-family homes sold in January since 2011, according to The Warren Group.

Article continues after...

Yesterday's Most Read Articles

‘Home away from home’: North Amherst Library officially dedicated, as anonymous donor of $1.7M revealed

‘Home away from home’: North Amherst Library officially dedicated, as anonymous donor of $1.7M revealed

‘We can just be who we are’: Thousands show support for LGBTQ community at Hampshire Pride

‘We can just be who we are’: Thousands show support for LGBTQ community at Hampshire Pride

South Hadley man killed in I-91 crash

South Hadley man killed in I-91 crash

Retired superintendent to lead Hampshire Regional Schools on interim basis while search for permanent boss continues

Retired superintendent to lead Hampshire Regional Schools on interim basis while search for permanent boss continues

A Waterfront revival: Two years after buying closed tavern, Holyoke couple set to open new event venue

A Waterfront revival: Two years after buying closed tavern, Holyoke couple set to open new event venue

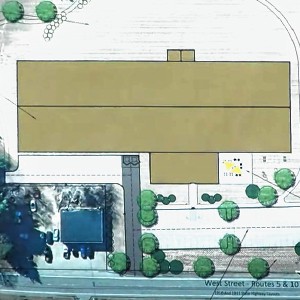

Proposed Hatfield pickleball/tennis building raising eyebrows

Proposed Hatfield pickleball/tennis building raising eyebrows

A continuing supply shortage is mostly to blame, said Cassidy Norton, associate publisher and media relations director for The Warren Group.

“There’s not enough housing,” she said.

Norton noted that rising interest rates not only discourage buyers — they can make potential sellers pull back, especially if they’re benefiting now from the low rates of the last 10 years, because a new mortgage will cost considerably more.

Norton said she expects prices to keep rising while sales numbers continue their downward trend in the coming months.

“Massachusetts is an expensive place to live,” she said. “I don’t see anything changing that.”

Some see signs, though, that prices are leveling off.

“We’re starting to see that market correction,” said Lori Beth Chase, president of the Realtor Association of the Pioneer Valley.

Chase said she sees buyers, confronted with more expensive borrowing, taking more time over their purchases. Properties on average are spending longer on the market.

Realtor Julie Held, co-owner of Maple and Main Realty in Northampton, said she has clients who are still trying to close on a home after more than two years of trying.

“They keep getting outbid,” she said.

Also playing into the competition are contingencies — prospective buyers who need to sell their current home before they can close on a new one. That can cause sellers to pass them over, Held said.

Some of January’s statistics, such as a 23% drop in median sale prices compared to the same month last year in Franklin County, can be seen not only as a result of a relatively small sample size — 36 closed sales — but as part of this process, Chase said.

“Last year was insane,” she said. “We saw a dramatic price increase in Franklin County, and this drop is a correction.”

Chase said she doesn’t expect home prices to drop, but predicts that they will continue to stabilize.

Condominium sales have largely followed a similar pattern. Condo prices in Hampshire County rose by almost 11% to a median of $300,000 in January compared to a year before, but the number of sales dropped by 35%, from 17 to 11.

Market analysts compare monthly sales activity to the same month in the previous year because the market is cyclical, Norton noted. There tends to be an uptick in sales in spring and summer, and a corresponding drop-off in winter.

Doors open at Tilton Library’s temporary home at South Deerfield Congregational Church

Doors open at Tilton Library’s temporary home at South Deerfield Congregational Church Area property deed transfers, May 2

Area property deed transfers, May 2 Pro-Palestinian encampment disperses at UMass, but protests continue

Pro-Palestinian encampment disperses at UMass, but protests continue