Latest News

Hadley planners advance battery storage bylaw

Hadley planners advance battery storage bylaw

Gun buyback event collects 195 unwanted firearms

Gun buyback event collects 195 unwanted firearms

Fearful Belchertown residents blame stray bullets on nearby gun club, appeal to town for help

BELCHERTOWN — Jake Hulseberg won’t let his children play on the swing set he built them in their backyard on Mountain View Drive because of bullets that shattered glass doors on two houses on the street.Instead, Hulseberg keeps his kids in the front...

Quabbin region studied for MWRA expansion

As House Democrats eye the expansion of its public drinking water service area, the Massachusetts Water Resources Authority (MWRA) is considering whether the communities where that water comes from should finally get to reap the benefits of the...

Most Read

Holyoke man finds bear paw in his yard

Holyoke man finds bear paw in his yard

Boyfriend accused in slaying of Hampden sheriff’s assistant, former legislator’s top aide

Boyfriend accused in slaying of Hampden sheriff’s assistant, former legislator’s top aide

Three finalists named for Ryan Road School principal in Northampton

Three finalists named for Ryan Road School principal in Northampton

Developer pitches new commercial building on Route 9 in Hadley

Developer pitches new commercial building on Route 9 in Hadley

Two men dump milk, orange juice over themselves at Amherst convenience store

Two men dump milk, orange juice over themselves at Amherst convenience store

Sadiq to leave Amherst middle school principal role

Sadiq to leave Amherst middle school principal role

Editors Picks

New federal mandate requires informed consent for sensitive exams

New federal mandate requires informed consent for sensitive exams

Painting a more complete picture: ‘Unnamed Figures’ highlights Black presence and absence in early American history

Painting a more complete picture: ‘Unnamed Figures’ highlights Black presence and absence in early American history

Area Briefs: Northampton kicks off Earth Day celebrations

Area Briefs: Northampton kicks off Earth Day celebrations

The Beat Goes On: Album release shows by Barnstar! and Lisa Bastoni, a Young@Heart Chorus concert with new special guests, and more

The Beat Goes On: Album release shows by Barnstar! and Lisa Bastoni, a Young@Heart Chorus concert with new special guests, and more

Sports

Boys lacrosse: Landon Andre, Nico St. George help Belchertown hold off Amherst 11-9 (PHOTOS)

BELCHERTOWN — After a quick 3-1 flurry from the Amherst boys lacrosse team erased Belchertown’s three-goal lead, the Orioles clung to a 9-8 advantage early in the fourth quarter on Thursday afternoon.Somebody had to step up for Belchertown to put a...

The Real Score: Curveballs and casinos rarely save cities

The Real Score: Curveballs and casinos rarely save cities

Baseball: Chicopee Comp strikes early, takes down Amherst (PHOTOS)

Baseball: Chicopee Comp strikes early, takes down Amherst (PHOTOS)

Florence’s Gabby Thomas gearing up for 2024 Paris Olympics

Florence’s Gabby Thomas gearing up for 2024 Paris Olympics

Opinion

Bridget Miller: Why walkability is the pathway to a healthy Amherst community

Picture a quiet rural town where the charm of winding roads and open spaces should invite pleasant walks and friendly encounters. Yet, instead of a stroll, residents navigate treacherous paths and dodge traffic on roads devoid of sidewalks or safe...

Guest columnist Mariel E. Addis: Under seige from all sides

Guest columnist Mariel E. Addis: Under seige from all sides

Julia Riseman: Join Friends of Northampton Trails

Julia Riseman: Join Friends of Northampton Trails

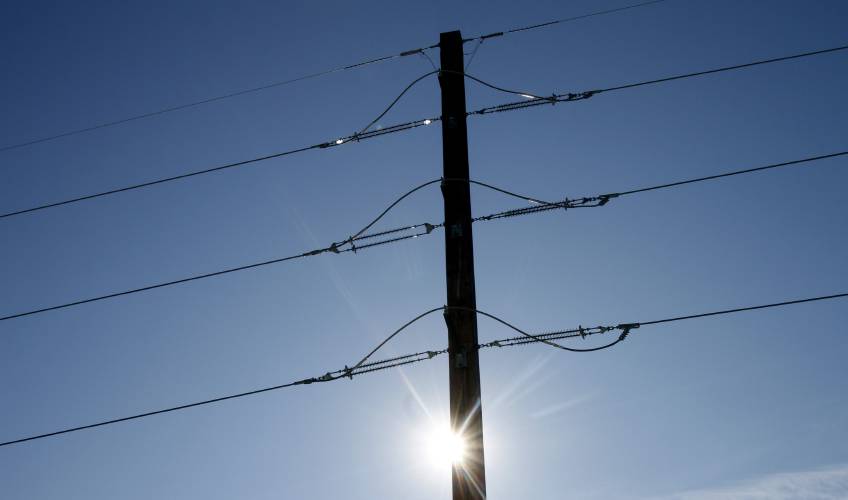

Justine McCarthy and Ed Lamoureux: Political will needed to benefit from new power line technology

Justine McCarthy and Ed Lamoureux: Political will needed to benefit from new power line technology

Shelly Berkowitz: More examples of corporate greed

Shelly Berkowitz: More examples of corporate greed

Business

Petition to block auto dealership on King Street falters in Northampton

NORTHAMPTON — A joint meeting between the Northampton City Council’s Committee on Legislative Matters and the city’s Planning Board heard public comments on a petition to ban further automobile dealerships near the city’s downtown, an issue that...

Flair and flavor: Couple draws on European, regional travel and food expertise to bring gourmet Aster + Pine Market to Amherst

Flair and flavor: Couple draws on European, regional travel and food expertise to bring gourmet Aster + Pine Market to Amherst

Prices up, sales down in early spring housing market

Prices up, sales down in early spring housing market

Area property deed transfers, April 18

Area property deed transfers, April 18

Tea Guys of Whately owes $2M for breach of contract, judge rules

Tea Guys of Whately owes $2M for breach of contract, judge rules

Arts & Life

Earth Matters: From Big Sits to Birdathons: Birding competitions far and near

A few months ago, headlines flared that Peter Kaestner had seen his 10,000th bird species. This could have been anticlimactic, as Kaestner has been renowned for years among birders for traveling worldwide and seeing more species than anyone.However,...

Obituaries

Garry Tudryn

Garry Tudryn

[IMAGE]GARRY TUDRYN HATFIELD, MA - Garry Morrison Tudryn, 67 of West Street in Hatfield, passed away April 13, 2024 at the Care One Nursing and Rehab Center in Northampton. Born in Northampt... remainder of obit for Garry Tudryn

Jacques Ben Abbes

Jacques Ben Abbes

HADLEY, MA - Jacques Ben Abbes, leaves his wife, Ngoc Anh Tran. Children; Vincent Tran (Nhu Nguyen) and Jacqueline Ben Abbes (Victor Loye) Grandchildren, Benjamin and Scott Tran. CALLIN... remainder of obit for Jacques Ben Abbes

Geraldine Packard

Geraldine Packard

Northampton, MA - Geraldine Packard, 87, passed away at her home in Northampton on April 13, 2024. Born to Curtis and Mildred (Smith) Chase on September 23, 1936 in Wolfeboro, New Hampshire... remainder of obit for Geraldine Packard

Russell E. Lent Sr.

Russell E. Lent Sr.

[IMAGE]Russell E. Lent, Sr. Easthampton, MA - Russell Eugene Lent, Sr. 89, longtime resident of Easthampton, passed away peacefully on Friday April 12, 2024, at his home. Born in Coshocton, ... remainder of obit for Russell E. Lent Sr.

State: South Hadley’s fiber-optic revenues not public records

State: South Hadley’s fiber-optic revenues not public records

Man granted parole for his role in the 2001 stabbing deaths of 2 Dartmouth College professors

Man granted parole for his role in the 2001 stabbing deaths of 2 Dartmouth College professors

Developer lands $400K loan for affordable housing project in Easthampton mill district

Developer lands $400K loan for affordable housing project in Easthampton mill district

Columnist Johanna Neumann: Reaping the rewards of rooftop solar

Columnist Johanna Neumann: Reaping the rewards of rooftop solar

Amherst Fire Chief Walter ‘Tim’ Nelson to retire in June

Amherst Fire Chief Walter ‘Tim’ Nelson to retire in June

First look at how little Amherst’s police alternative being used called troubling

First look at how little Amherst’s police alternative being used called troubling

High schools: Offense on fire for Granby girls lacrosse in 20-2 win over McCann Tech

High schools: Offense on fire for Granby girls lacrosse in 20-2 win over McCann Tech Speaking of Nature: Indulging in eye candy: Finally, after such a long wait, it’s beginning to look like spring is here

Speaking of Nature: Indulging in eye candy: Finally, after such a long wait, it’s beginning to look like spring is here Weekly Food Photo Contest: This week’s winner: Nicholas Horton of Northampton

Weekly Food Photo Contest: This week’s winner: Nicholas Horton of Northampton What does freedom look like today? On view at Williams College, seven Black American artists interpret the meaning of emancipation

What does freedom look like today? On view at Williams College, seven Black American artists interpret the meaning of emancipation Spring brings new art: A look at what's on tap in April at selected local galleries

Spring brings new art: A look at what's on tap in April at selected local galleries